Table of Contents

You took out a mortgage and have a set mortgage payment each month. You assume you just make those payments and pay the debt off in 15 – 30 years, right?

What if you could pay your mortgage off early, though?

It’s possible. The mortgage amortization is set up to pay your loan off within your set term (15 – 30 years), but that doesn’t mean you can’t make extra payments and pay it off early. Unless your loan has a prepayment penalty (which most don’t today), you can pay your loan off as early as you want.

Can you Save Money Making an Extra Mortgage Payment?

Most people only want to make the minimum payment. After all, a mortgage bill is usually the highest monthly payment that most people make. But what if you could save money by making an extra mortgage payment?

In most cases, you can. Here’s why.

When you have an extra mortgage principal payment, you pay down the loan balance. This means you pay less interest over the life of the loan because your interest payments are based on the loan’s balance.

The faster you pay the balance down, the less interest you pay.

Here’s a quick example.

If you borrow $240,000 at 4% for 30 years, your minimum payment is $1,145.80 and you’ll pay a total of $412,486 for the loan.

If you pay an extra $100 each month for 30 years, you’d pay $1,245.80 a month and a total of $384,719, saving $27,767 overall and cutting 4 years and 3 months off your loan.

The more you pay, the less interest you’ll pay and the faster you’ll pay off your loan.

Questions to Ask Before Making an Extra Mortgage Principal Payment

Before you make extra payments toward your mortgage, there are some questions you should ask your lender to make sure it’s the right choice for you.

How will my extra payments be applied?

Don’t assume your lender will apply extra payments to the principal, especially if you don’t make the extra payment with your monthly mortgage payment.

Ask the lender if any extra funds go directly toward the principal or if they pay down the interest. You want them to pay down the principal, so make sure you always specify this when you make the payment and make it with your monthly mortgage payment to be sure.

Most payment coupons have a box to check that says apply $x toward principal. Make sure to check the box.

Are there any Fees?

Most banks don’t charge fees for prepaying a mortgage today, but always ask. Some banks don’t charge a pre-payment penalty but do charge a fee for payments made outside of your regular mortgage payment.

Read the fine print on your mortgage paperwork or call your loan servicer to find out. It’s easiest to make the extra payment with your mortgage payment so you don’t have to worry about fees, but if you have extra money you want to pay outside of that timeline, talk to your loan servicer first.

If your loan has a prepayment penalty, this means you’ll pay a percentage of the loan amount IF you pay the loan off IN FULL within the specified period. It’s usually 3 years, but every lender has different requirements.

Can you make a Principal Only Payment?

A principal only payment is an extra payment you make separate from your regular payment. Let’s say you get a tax refund, and you want to apply it toward your mortgage. It’s the middle of the month and you’ve already paid your mortgage this month.

You can make a principal only payment by selecting that option on your payment coupon or when you pay online. The principal only payment lowers the amount you owe for the loan and decreases the total interest you’ll pay.

Ways to Make an Extra Mortgage Payment

There are many ways to make an extra mortgage payment. Here are the most popular ways.

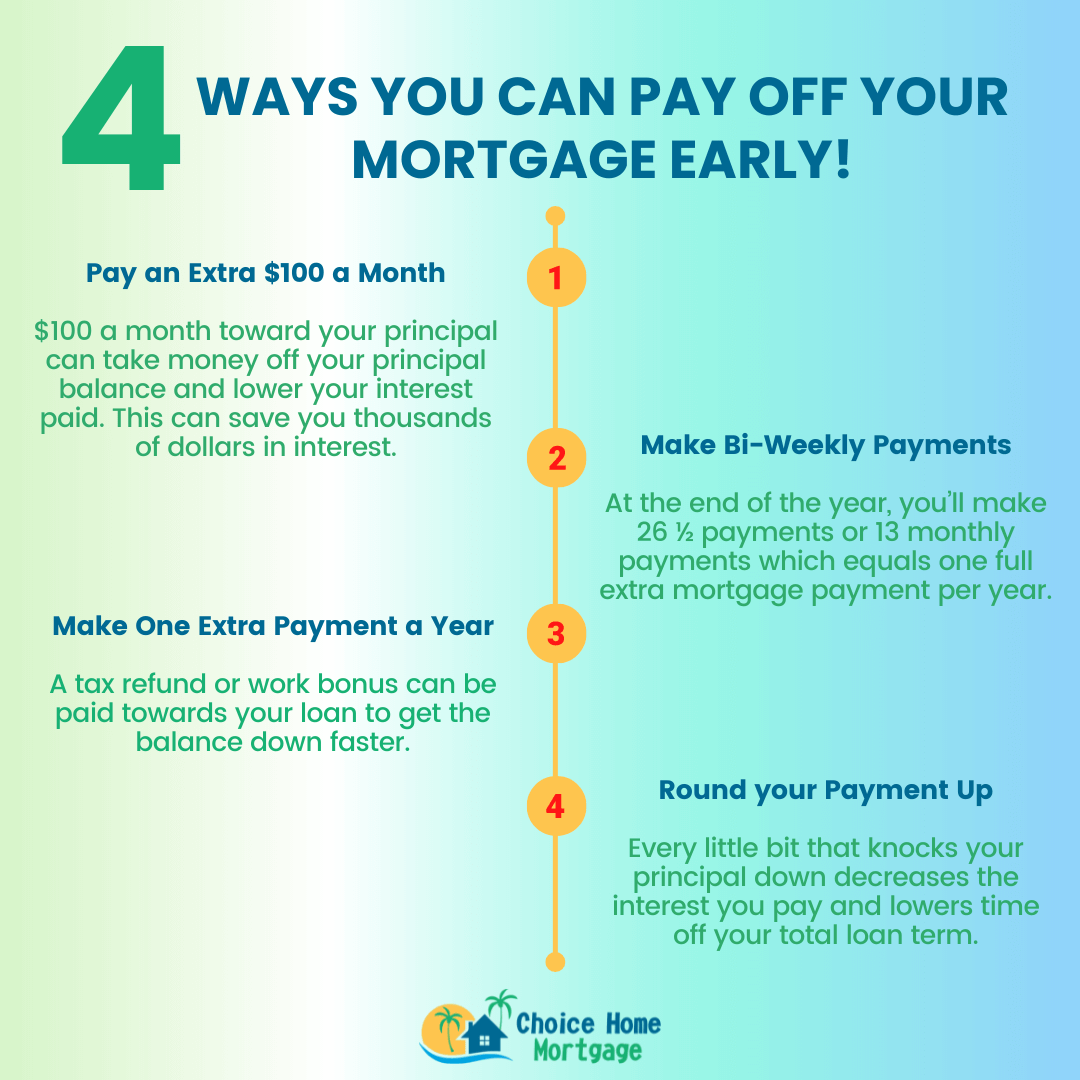

Pay an Extra $100 a Month

It doesn’t sound like much, but even $100 a month toward your principal can knock money off your principal balance and lower your interest paid. As we showed in our example above, $100 a month every month for the loan term knocks off 4+ years off the loan term and you can save $27,000.

This just goes to show that any amount helps decrease the total amount you pay for a mortgage. The key is consistency. Paying $100 (or any amount) as regularly as possible can save you thousands of dollars in interest.

Make Bi-Weekly Payments

If your lender allows it, you can make bi-weekly payments. Some services offer a program for this, but they charge a fee for it. Instead, if it’s allowed, do it yourself. Here’s how.

Split your mortgage payment in half, making a payment every 2 weeks. For example, if your mortgage payment is $2,000, pay $1,000 every 2 weeks. At the end of the year, you’ll make 26 ½ payments or 13 monthly payments which equals one full extra mortgage payment per year.

It doesn’t feel like you’re paying anything extra, and you’ll save money on the total interest paid on the loan.

Make One Extra Payment a Year

If you come into money once a year, such as with a tax refund or work bonus, consider paying it toward your mortgage. You don’t have to worry about budgeting extra money each month toward your loan and you still pay the balance down faster.

Some ideas to get money for an extra annual payment include:

- Income tax refund

- Work bonus

- Work commission

- Financial gifts

Round your Payment Up

As stated said earlier, you don’t have to make large payments to make a huge difference in the interest you pay. Even rounding your payment up to the nearest $100 can help.

Let’s say for example your payment is $1023. If you round up to $1,100, you pay an extra $77 a month. That’s $924 per year and $9,240 over 10 years. Every little bit that you knock your principal down decreases the interest you pay and even knocks some time off your total loan term.

Make Extra Principal Payments Sporadically

You don’t have to have a method to how you make principal payments, either. If you have extra money every so often that you put toward your mortgage, it will have the same effect. While consistency is great and will have the most impact on your total interest paid and how early you pay your loan off – there’s nothing wrong with making random extra payments!

Extra Payment Mortgage Refinance Calculator

See if you should refinance your mortgage. Enter the details of your current home loan along with details of a new loan to estimate your savings and see if refinancing is right for you!

Refinance Saving

Reasons Not to Make an Extra Mortgage Payment

Sometimes it doesn’t make sense to make an extra principal mortgage payment. It depends on your financial situation. Sometimes other expenses or debts take priority. Here’s what to consider.

Do you Have a Lot of High Interest Debt?

You’re making extra mortgage payments to cut down the interest you pay, but if you carry a lot of high interest credit card debt, you’re defeating the purpose. Credit card interest rates are much higher than any mortgage rate, so it’s always best to pay off the credit cards first and then focus on paying your mortgage off faster.

Do you Have an Emergency Fund?

Any money you pay toward your mortgage is tied up in the home. Yes, you could refinance with a home equity loan or cash-out refinance, but that takes time. If you don’t have an emergency fund, it’s best to save that first and then pay extra toward your mortgage.

An emergency fund should have 3 – 6 months of expenses in it. This should protect you financially if you lose your job or are unable to work because you fell ill or had another emergency.

Are you Getting your Employer Match?

If your employer offers a 401K employer match, take advantage of it. At the very least, contribute the amount your employer will match. For example, if they will match 3% of your salary and you make $100,000, you should contribute at least $3,000 to your 401K to get the free $3,000 from your employer.

Any money beyond that can be invested toward paying off your mortgage early, but always get that employer match first.

You Have a Prepayment Penalty

If your lender charges a prepayment penalty, make sure you know the terms. Typically, just making extra payments won’t incur a penalty unless you’re paying off the loan extremely early in the term. In that case, you may be subject to a penalty that wouldn’t make paying the extra money worth it.

Pros and Cons of the Extra Mortgage Principal Payment

Pros:

You’ll pay less interest

The largest advantage of making extra payments is that you could save thousands of dollars in interest. Look at the total cost of the loan and then compare it to if you made extra payments in the amount you can afford to see the savings.

You’ll build equity fast

When you make an extra mortgage principal payment, the money goes directly to the principal. This means you owe less which increases your equity. Since most homes appreciate over time too, you’ll build equity a lot faster if you make extra payments.

You’ll own the home faster

If your goal is to live in the home long term, you’ll own it faster by paying the principal down faster. This increases your net worth and decreases your expenses during retirement, which can be a lifesaver for many people.

Cons:

You’ll lose your tax deductions

Mortgage interest is tax-deductible. If you itemize your deductions, you may rely on the deduction for mortgage interest since it’s usually a large deduction, especially at the beginning of a loan term.

It’s an opportunity cost

The money you invest in your home has the opportunity cost of not being invested elsewhere. If you don’t invest in anything except your home, you aren’t diversifying your portfolio which could put you at risk for a total loss if the housing market crashes again.

You may not be able to save for other things

If you have other financial goals, like buying a car, saving for retirement, saving for college, or even taking a dream vacation, you might not save as much as you should if you put extra money toward your mortgage.

How to Tell if Paying Extra Toward your Mortgage is Worth It

To decide if you should pay extra toward your mortgage, ask yourself the following questions:

Do you live paycheck to paycheck?

If money is already tight, paying extra toward your mortgage isn’t the right choice at the moment. Get yourself back on your feet, pay off your high-interest debt and then focus on paying your mortgage down.

Do you get large windfalls?

If you get regular windfalls, you may consider putting them toward your mortgage. If you’ve met your other financial goals or have a plan to meet them with regular savings, then put the windfall toward your mortgage and save on interest.

Are you staying in your home long-term?

If you’re staying in your home long-term, paying the principal balance down faster makes sense. You’ll save on interest over the long term. But, if this is a short-term purchase, paying the balance down won’t’ save you much on interest since you’ll sell the house soon.

Do you have an emergency fund and retirement savings?

Make sure you’re set in other areas of your life. The money tied up in your home will remain there until you sell it or unless you refinance. Don’t tie up money you might need for other purposes.

Final Thoughts

Making extra mortgage principal payments every now and then can be a great way to save money. It’s even better if you can make them regularly as you can save thousands of dollars on interest over the life of the loan.

If you’d like to learn more about how to save money on your mortgage or how to find the right mortgage for you, contact us today!