Table of Contents

If you’re currently retired or about to retire, the high inflationary rates may have you worrying that you’ll run out of funds before your time here is up. You aren’t alone.

Inflation is up 7.9% over the last 12 months, giving everyone, but especially retirees reason to worry. With costs constantly increasing, you either need to save more money or drastically cut back on your spending, neither of which are easy for retirees.

Fortunately, there is a way to hedge against inflation and that’s with the equity in your home. Real estate has always proven to be a good hedge against inflation, but when you’re a retiree, the last thing you want is to start investing in real estate.

But there’s good news.

If you already own a home, a reverse mortgage can help you deal with the costs of inflation, while giving you the money you need to continue living your retirement dreams.

What is a Reverse Mortgage?

Before we jump into how a reverse mortgage can help you with inflation, let’s look at what a reverse mortgage is and how it works.

A reverse mortgage is a mortgage against the equity in your home. Most people who take out a reverse mortgage own their home free and clear, but you can also take out a reverse mortgage if you have a small mortgage balance.

With a reverse mortgage, you don’t make monthly principal and interest payments like you do with a traditional mortgage. Instead, as the name suggests, you receive payments monthly from your home’s equity and don’t owe any principal or interest until you sell the property or don’t live in it full time.

How a Reverse Mortgage Works

In order to get a reverse mortgage, you first need equity in your home. You can leverage your equity by taking out a reverse mortgage, using the equity while you’re alive rather than leaving it for loved ones when you pass or being forced to sell your home and downsize to save money.

With a reverse mortgage, you can use your home’s equity, live in the home full-time, and not have to worry about monthly payments. It’s a win-win for retirees.

How a Reverse Mortgage can Help Hedge Against Inflation

You might wonder how a reverse mortgage would help you hedge against inflation. There are a few ways.

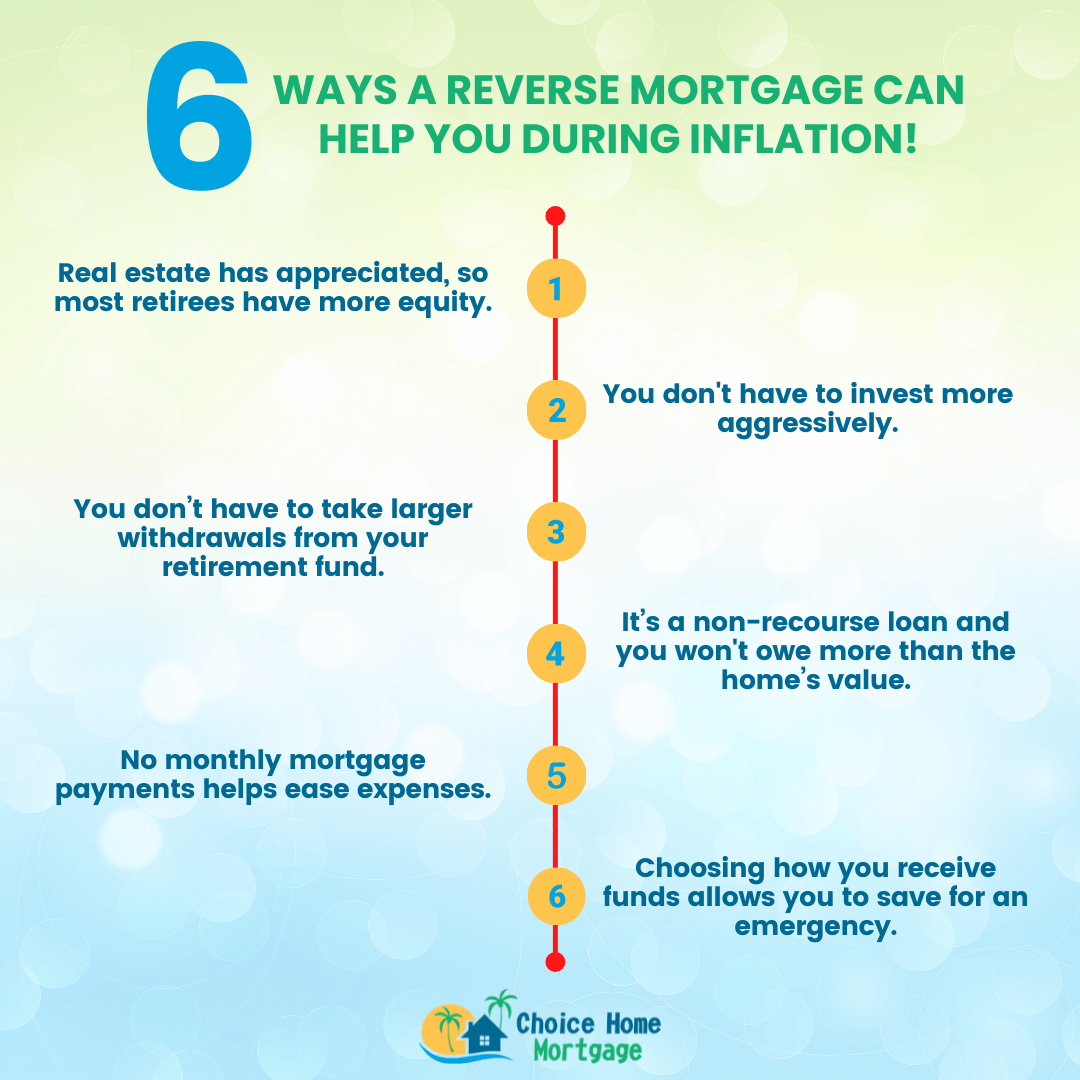

Real Estate has Appreciated, so most Retirees have more Equity

If you own your home free and clear, you likely have more equity now than you did a couple of years ago. Real estate values increased considerably in most areas, leaving homeowners with more equity than they had before.

You can use that equity to supplement your retirement income to offset the higher daily cost of living we’re all experiencing.

You Don’t Have to Invest more Aggressively

Without equity in your home and the chance to tap into it, you might be forced to invest more aggressively in the hopes that your portfolio grows faster. Here’s the problem, though. Stock values often fall during times of high inflation. This means you’re risking the money you have for the small chance of earning more, but it’s not likely.

Investing more aggressively puts you at a much higher risk of default which can make your financial situation even worse.

With a reverse mortgage, you don’t have to touch your portfolio and if anything, you could even make it more conservative so you can preserve what you’ve earned thus far while ensuring that you have money to cover the higher costs.

You Don’t Have to Take Larger Withdrawals from your Retirement Fund

With high inflation rates, many people start taking larger withdrawals from their retirement funds. However, if you carefully planned so that you’d have just enough money to last your expected lifetime, this can be detrimental to your finances.

Most people stick to the 4% rule, withdrawing no more than 4% of their retirement fund annually. If they planned well, they’d have enough money to cover their retirement years, but most don’t have enough to cover unexpected inflation like we’re experiencing now.

The Benefits of Choosing a Reverse Mortgage to Help During Inflation

You might worry about taking out a mortgage on your home now, especially after you’ve worked so hard to pay off your mortgage, but here are the benefits of using a reverse mortgage to help during inflation.

You Choose How you Receive the Funds

You don’t have to take your entire disbursement upfront. You can choose from many different payout options based on your perceived financial needs or what you’re comfortable with. You aren’t obligated to use the funds if you receive them either – you can save them as an emergency fund should inflation be too much for you to handle.

Few Out of Pocket Expenses

You can typically include all reverse mortgage closing costs in your loan. This means you have to bring little to no money to the closing table, which helps tremendously especially if you’re taking out a reverse mortgage to help with increasing costs.

It’s a Non-Recourse Loan

You don’t have to worry about your home’s value falling and you owing more than the home is worth when you sell the home or if you die and your heirs sell it. A reverse mortgage is a non-recourse loan which means no one will owe more than the home’s value when the mortgage becomes due and payable.

You can Choose a Fixed or Adjustable Rate Loan

Depending on how you receive the funds (line of credit, full disbursement, etc.) you can choose a fixed or adjustable rate loan. If you’d prefer to know exactly how much you’d owe when the loan is due and payable, a fixed rate loan is better. But, if you like the flexibility of a line of credit, you’ll have to have an adjustable rate loan.

You Don’t Owe Payments Monthly

You aren’t on the hook to make monthly payments on a reverse mortgage. You can make interest payments if you want to keep the balance owed down, but there’s no obligation to do so.

The loan doesn’t become due and payable until you move out of the home, sell the home, or pass away.

Options for Reverse Mortgage Distributions

As you explore your options to use a reverse mortgage to hedge against inflation, it helps to know what options you have for distributions.

Lump Sum Distribution

A lump sum distribution means you get all of your money upfront. You can do what you want with the funds including investing them, but keep in mind that interest accrues from day one on the full amount. If you don’t have an immediate need for the full amount, you may want to consider other disbursement options.

Line of Credit

This is a common way to take your funds. You receive a line of credit that you can access, but don’t have to. You can draw funds as you need them or leave them in the account. Any unused funds may earn interest. It’s like an increasing credit line as you age, giving you access to more funds if you leave your line of credit unused.

Tenure Payment

You can receive a fixed monthly payment for as long as you own the home. This is like having your house pay you. There isn’t a time limit on how long you can receive the funds, and even if your distributions exceed your home’s value over time, you can still receive the funds as long as you occupy the home as your primary residence.

Term Payments

You can receive regular monthly payments for a fixed period. Say for example, you want to offset the risk of inflation and you see a need for the extra funds for 10 years, you can receive equal installments of the available funds over the next 10 years.

Who Qualifies for a Reverse Mortgage?

If taking out a reverse mortgage to hedge against inflation sounds like something you’d consider, here’s what you must know about qualifying for a reverse mortgage.

Minimum Age Requirements

Normally we’d talk about financial requirements to qualify for a mortgage first, but a reverse mortgage works differently. It’s a mortgage only for homeowners ages 62-years and older to help supplement your retirement income.

If you own the home with someone else, the amount you receive is based on the age of the youngest borrower. The younger you are when you take out a reverse mortgage (62 is the youngest), the less money you’ll receive because you’ll have a longer life expectancy than someone who is older.

Home Requirements

You must own the home as your primary residence, which means you live there year-round. You must also own the home free and clear or if you have a small mortgage amount, it must be paid off with the proceeds before you receive any. The more equity you have in the home, the more money you can borrow to hedge against inflation.

Financial Requirements

Even though you don’t owe payments on a reverse mortgage, you must still qualify for it financially. This means two things:

- You can afford the taxes, home insurance, and regular home maintenance

- You took a reverse mortgage counseling course to ensure you understand the reverse mortgage process

If you aren’t unable to keep up with your taxes, insurance, or home upkeep, the loan could immediately become due and payable.

Extra Payment Mortgage Refinance Calculator

See if you should refinance your mortgage. Enter the details of your current home loan along with details of a new loan to estimate your savings and see if refinancing is right for you!

Refinance Saving

Should you Take a Reverse Mortgage to Fight Inflation?

High inflationary periods are scary for anyone, but most importantly for retirees on a fixed income. If you carefully planned your retirement savings and now find yourself needing more money than you planned annually just to get by, a reverse mortgage could be just what you need.

Think of it as protecting yourself. You don’t have to take the distributions if you don’t have an immediate need for the funds but having a line of credit available to you should prices increase even more and you can’t keep up can be a lifesaver.

With today’s low interest rates, you can take the money out, not worry about getting in over your head to pay the loan back and you won’t have to touch your investment accounts. Why upset the plans you already made for this great time in your life when you can protect yourself by using the largest asset in your life – your home?

If you’re interested in learning more about how a reverse mortgage can help you fight against inflation and keep you from worrying during retirement, contact us today!