Table of Contents

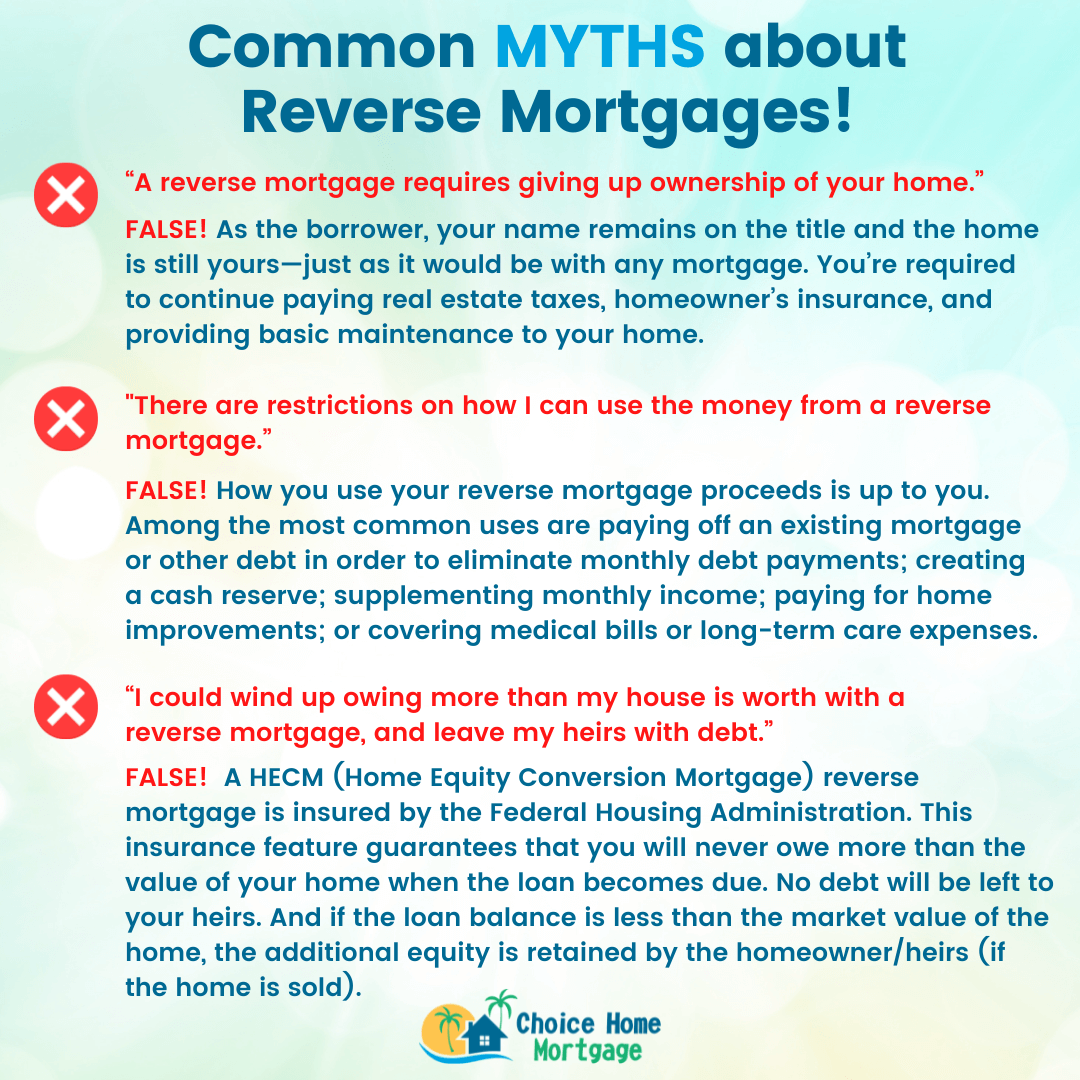

The reverse mortgage carries many myths that people believe. These myths could be holding you back from one of the most helpful ways to supplement your retirement funds. When done correctly, the reverse mortgage can be a helpful personal finance tool that allows you to stay in your home while enjoying the equity you have built up over the years during retirement.

What is a Reverse Mortgage?

First, let’s cover the basics.

A reverse mortgage, as the name suggests, is a mortgage that allows you to use your home’s equity without traditional monthly payments like a home equity loan would require.

It’s available to homeowners ages 62 and older and your loan amount is based on your age. The older you are when you take out the reverse mortgage, the more money you can borrow since it’s based on your life expectancy.

You don’t owe payments on the reverse mortgage monthly. Interest accrues, but you don’t have to make any payments until you move out of the home, sell it, or pass away. At that time, the loan becomes due and payable, and you or your heirs will use the proceeds of the sale of the home to pay off the loan.

How Does it Work?

When you take out a reverse mortgage, you borrow against the home’s equity based on your current age. The amount you can receive is based on the youngest age of you or your spouse (if applicable) and both must be over the age of 62.

If you qualify, you can choose how you’d like to receive your funds. Here are some common ways:

- Equal monthly payments for your lifetime – As long as one spouse lives in the property, you can get an equal monthly payout from your home’s equity.

- Equal monthly payments for a term – If you want to supplement your income for a certain amount of time, you can select the term you’d receive monthly payments.

- Line of credit – You get a line of credit you can use at any time. You aren’t obligated to use it, but it’s there if you need it.

- Combination of the above – You can combine a line of credit with either a lifetime of equal monthly payments or monthly payments for a fixed term.

Now, let’s get to the myths about the reverse mortgage.

Top Reverse Mortgage Myths

Myth: A reverse mortgage is like a home equity loan

A reverse mortgage and home equity loan have one thing in common – they both allow you to access your home’s equity. Beyond that, though, they are very different.

A home equity loan requires monthly payments. If you don’t make your payments, you could face foreclosure. A reverse mortgage doesn’t require payments while you live in the home. Interest accrues, but they are added to the back of the loan. Nothing is due and payable until you sell the home or no longer live in it.

Myth: Your heirs won’t inherit your home

The truth is your heirs will inherit the home, just like they would inherit any other assets in your estate that you leave behind. However, if there is a reverse mortgage balance, the estate must cover the loan before distributing any of the money to the heirs.

The only asset that must be liquidated to pay the loan is the home and if the heirs want to keep the home, they can pay it off using their own funds.

Myth: You might owe more than the home is worth.

A reverse mortgage is a non-recourse loan. This means you will never owe more than the home’s value. If values in the area fall, you or your heirs (whoever pays the loan when it’s due and payable) will only owe the lesser of the home’s value or the loan balance.

The reverse mortgage is an FHA program and just like traditional FHA loans, the FHA guarantees reverse mortgages, promising to pay the lender the difference if the home is worth less than the borrower owes when the loan is due.

Myth: You can’t ever leave your home

Some people believe they must be in their home 365 days a year to not trigger the reverse mortgage’s due and payable clause, but this isn’t the case. You must live in the home a majority of the year and prove the home is your primary residence.

But you can leave. Whether you take a trip for a couple of months or you have to go to a nursing home or rehab facility temporarily, it doesn’t automatically trigger the loan’s due and payable clause. If you are gone for more than 12 consecutive months, then it might trigger it, otherwise, you are still free to live your life.

If you plan to leave the home for a few months at a time, a quick call to the lender isn’t a bad idea to let them know just so everyone is on the same page, but it won’t trigger your loan’s due and payable clause.

Myth: You need great credit to get a reverse mortgage

While your credit does matter, it’s not the only factor that determines if you qualify for a reverse mortgage. Instead of great credit, you must be able to prove that you can comfortably handle the home’s responsibilities including the annual taxes, homeowner’s insurance, maintenance, and repairs.

Myth: The bank takes ownership of your home

It might feel like you’re giving up ownership of your home when you take out a reverse mortgage, but you retain the title. You also retain some equity in the home – it wouldn’t be a smart business practice of the FHA to insure loans that use up 100% of a home’s equity.

While you are required to pay the loan back from the home’s proceeds when you sell it, any difference is yours or your heirs’ if they sell your home.

Myth: The bank could force you out of your home

The bank will never force you out of your home with a reverse mortgage. In fact, the program is meant to help you stay in your home as long as possible. It makes the most sense for homeowners that plan to live in the home for many years, but anyone over the age of 62 can apply.

The bank won’t force you out of your home at any point though as long as you meet these requirements:

You pay your real estate taxes on time

You pay your homeowner’s insurance on time

You maintain and repair the home

You live in the home as your primary residence

Myth: A reverse mortgage will affect my Social Security income

While many income sources during retirement can affect your Social Security income, a reverse mortgage doesn’t, even if you receive the funds monthly.

Here’s why:

The money from your home isn’t income. It’s money you already paid taxes on. The IRS doesn’t tax the money which means you don’t pay taxes when you withdraw the funds using your reverse mortgage.

You might pay taxes on any capital gains if there are any when you sell the home, but the income you receive while you live there doesn’t affect your Social Security income.

Myth: You can’t get a reverse mortgage if you have an existing lien on your property

While it’s best if you own the home free and clear before taking out a reverse mortgage, you may still qualify if you have an existing lien. In order for it to work, you must be able to pay the loan off with the proceeds of the reverse mortgage first.

Any remaining funds can be distributed as you choose among your options for fund disbursement.

Myth: A reverse mortgage takes advantage of retirees

The opposite is actually true. A reverse mortgage protects retirees. Since today’s life expectancy is much higher for most people, many retirees worry about running out of money and being forced to leave their homes.

With a reverse mortgage, they can stay in their home for the rest of their life or as long as they are able and have the money to do so. The equity from your home can supplement your regular retirement income and ensure you are able to stay where you want.

Myth: Reverse mortgages have excessive fees

Any mortgage has fees – it’s the only way lenders can stay in business, but the reverse mortgage doesn’t have excessive fees. There is an upfront mortgage insurance fee that allows the FHA to guarantee the loan for lenders so it can be a non-recourse loan (you’ll never owe more than the home is worth).

Any costs you incur for a reverse mortgage can be wrapped into the loan and paid when you sell the home, though. The only fee you must pay out of pocket upfront is the reverse mortgage counseling fee because it’s paid to a third-party counseling agency.

Myth: Your spouse will have to leave if you die

Your spouse is entitled to stay in the home if you pass away first. How it’s handled depends on if your spouse is a borrowing or non-borrowing spouse.

A borrowing spouse can remain in the home as long as he/she can afford the taxes, insurance, and the home’s upkeep. Your spouse will continue receiving payments as scheduled in the reverse mortgage agreement too.

A non-borrowing spouse can also remain in the home; however, he/she will not continue to receive payments from the loan. A non-borrowing spouse must also prove he/she can keep up with the home’s obligations though.

Myth: A reverse mortgage should be a last resort

A reverse mortgage can be a solid personal finance tool in your toolbelt. If you worry about outliving your retirement funds, you can take out a reverse mortgage as a line of credit. This way you have the funds there in the case of an emergency, but you don’t have to use them.

Even if you take payouts, you aren’t obligated to pay the loan back until you leave the home (or die). So either way, it can be a great way to protect yourself during retirement.

Extra Payment Mortgage Refinance Calculator

See if you should refinance your mortgage. Enter the details of your current home loan along with details of a new loan to estimate your savings and see if refinancing is right for you!

Refinance Saving

Final Thoughts

A reverse mortgage can be a great way to protect yourself during retirement. The myths that most people believe aren’t true and could hold you back from getting the funds you need during retirement.

Your home is your largest asset and can help you have enough money to enjoy retirement while staying in the home you invested in all these years. Whether you have a mortgage on it now or you own it free and clear a reverse mortgage can supplement your retirement income and allow you to enjoy your home’s equity while remaining in the home.