Table of Contents

Your credit score is one of the most important aspects of your personal finances. A great credit score can get you the best rates and terms on loans, including a mortgage. Your credit score is the first thing lenders look at when you apply for a loan, and it’s even used when you apply for new insurance or sometimes a new job.

Tradelines are what makes up a credit score. They are the meat behind the calculations and are something you should understand so you can boost your credit score.

What are Tradelines?

A tradeline is the credit account reported on your credit report. Anytime you apply for and get a new credit line, it’s reported to the credit bureaus (with a few exceptions). Each tradeline is a separate account. Even if you have multiple accounts with the same bank, each account is its own tradeline.

Types of Tradelines

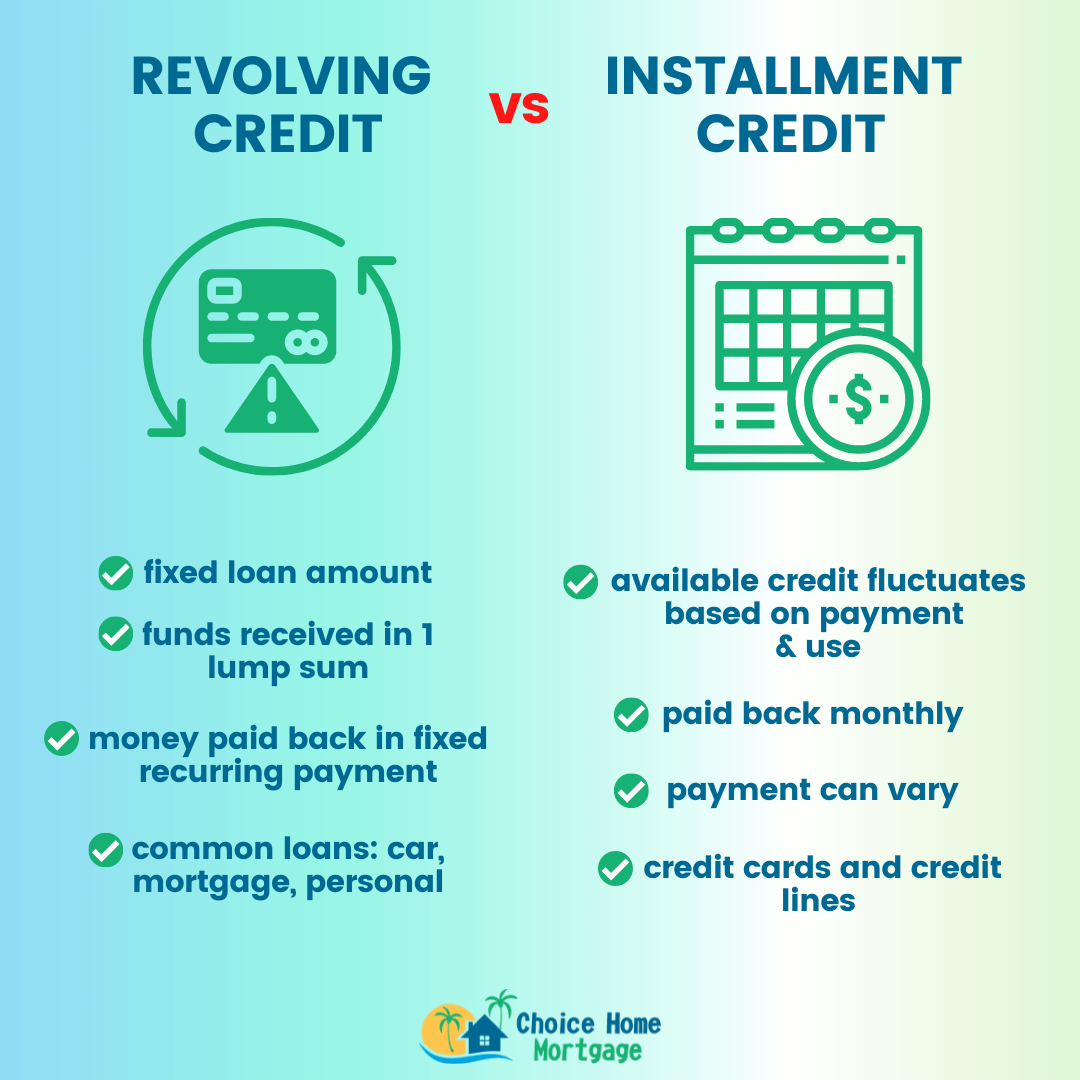

There are two main types of tradelines – revolving and installment.

Revolving tradelines are credit cards or card lines. They are revolving because you can reuse the funds once you pay the amount borrowed back. Think of your credit card. Let’s say you have a $1,000 credit line and you charge $1,000. If you pay back $500 of it, your available credit becomes $500, because it’s revolving.

Installment tradelines have a fixed loan amount that doesn’t revolve. You receive the funds in one lump sum and pay the money back in a fixed payment of principal and interest. Common installment loans are car loans, personal loans, and mortgages.

What Information is Included in Tradelines?

No matter the type of tradeline you have, it includes quite a bit of information about you. The credit bureaus use this information to calculate your credit score and other lenders use the information to decide if you’re a good risk.

Tradelines include some or all of the following information.

Lender Information

This section displays information about the lender including the name and address. Sometimes the information is abbreviated, so you might have to do a little digging to realize which bank it is reporting on your credit report.

Type of Account

The type of account is either installment or revolving. This plays a role in your credit score because a good credit mix helps your credit score. It also shows lenders how much revolving debt you have available. Too much revolving debt could be risky because it gives you more opportunity to rack up credit card debt and get in over your head.

Account Number

The account number is usually abbreviated, showing only the last few numbers. Match up the numbers with your account to make sure it’s the right account when checking your credit.

Open or Closed

It’s not just open accounts that report on your credit report. Tradelines can stay on your credit report for many years. The open or closed status lets lenders know how much debt you have currently. If it’s closed, it may also state the reason (lender forced, consumer chose to close, paid off, etc.).

Dates

Tradelines show the date you opened the account and closed it, if applicable. This is important too because if you have too many accounts opened recently, you could pose a higher risk of default. Your credit’s ‘age’ also affects your credit score. The older your accounts are, the more it helps your credit score.

Original Balance

The original balance shows lenders how much you borrowed, and they can compare it to your current balance to see how much you’ve paid off. This also shows lenders the amount of your credit line for any revolving debt. Larger credit lines can pose a higher risk because you have more chances to charge more than you can afford.

Current Balance

This is the amount you currently owe. It helps lenders determine your debt-to-income ratio and how much debt you have outstanding. The lower your current balances are compared to your credit line for revolving debt, the better it is for your credit score.

Payment History

Your payment history is the largest part of your credit score (35%). This is where it reports if you made your payments on time or late. If you made payments late, they are reported in 30-day increments – 30 days late, 60 days late, 90 days late, or 120+ days late. The later your payments are, the more it hurts your credit score.

Required Monthly Payment

The required monthly payment shows how much you must pay each month. This also affects your payment history if you don’t make the full payment by each due date.

How do Tradelines Increase your Credit Score?

The information in your tradelines is what makes or breaks your credit score. If you use your tradelines wisely, they can help your credit score.

So how do they help? Here are the top ways to treat your tradelines to get the best credit score possible.

On-Time Payment History

Your payment history is the most important aspect of your credit score and is the number one way to boost your credit score.

An on-time payment history can increase your credit score fast. If you fall behind and have late payments, you can fix the issue by bringing your payments current and making future payments on time.

If you fall behind and can’t catch up, work with your lender to create a plan to better manage your debt. They might be able to adjust your due date or put you on a payment plan so you catch up and your credit can start benefiting from the on-time payments.

Low Current Balance Compared to your Credit Line

Your current balance plays a big role in your credit score too, mostly for revolving debts. If you have a large current balance, you might be at a high risk of default. For example, if you have a $5,000 credit line and have $4,000 outstanding already, you are a higher risk.

The credit bureaus calculate what they call your credit utilization rate. This is the comparison of your outstanding balance to your credit line. The lower your credit utilization rate is, the better it is on your credit score. The ideal ratio is 30%.

Don’t Close Accounts

You can close accounts at your own will, but having an account closed for you won’t help your credit score.

Ideally, you’d keep all accounts open to increase your credit age. The older your credit age is, the better it is for your credit score. Newer credit is risky because it doesn’t have a long history behind it. The older credit gets, the more information lenders and the credit bureaus have to use to determine if you’re a high risk of default.

Can Tradelines Hurt Your Credit Score?

Just as tradelines can help your credit score, they can hurt them too. Here are the top ways tradelines can hurt your credit score.

Late Payments

Late payments are the number one way to hurt your credit score. You can lose as much as 100 points with one late payment. How a late payment affects your credit score varies by situation, but it almost always causes a score to drop significantly.

High Balances

High balances are the next most important factor in your credit score. Your tradelines show how much money you have outstanding compared to your credit limits. High balances show the credit bureaus that you might not handle your finances well and it can hurt your credit score as a result.

Too Many Revolving Accounts

Having too many credit limits at your disposal can be risky. Since you can reuse the credit lines, you have a lot of credit available for use which could mean you put yourself in over your head in debt. The potential is there, even if you don’t do it, which could hurt your credit score.

Too Many New Accounts

Applying for too many accounts at one time can be hard on your credit score. New credit is risky because it’s a new debt you have to manage. There’s no history behind it so until you get established and the credit gets older, it will hurt your credit score.

How to Make Sure your Tradelines are in Good Standing

Tradelines are the only way to improve your credit score, but they must be in good standing to make it work. To make sure your tradelines are in good standing, do the following.

Pull your Free Credit Reports

Everyone gets free access to their credit reports weekly. Check yours often, looking for any errors (human or fraudulent) and any issues you can clear up. If you find incorrect information on your credit report, write a dispute letter to the appropriate credit bureau.

If you discover you missed a payment, overextended your credit, or made other mistakes, do what you can to fix the issue quickly to help your credit score bounce back.

Make your Payments on Time

Always make your payments on time. If you can’t, contact your creditor and work out a plan. Letting your account go unpaid without any communication with the creditor is the number one way to hurt your credit score.

If you fall behind, don’t assume it’s over. Your credit score can change monthly, so get back on track as quickly as you can to help your credit score increase.

Keep Your Credit Balances Low

Just because you have a high credit limit doesn’t mean you should spend all of it. At the most, you should have 30% of your credit limit outstanding, which is $300 for every $1,000 credit line. If you charge over 30% of your credit limit, make sure you can pay all or most of it off so that your credit limit has no more than 30% outstanding when the tradeline is reported to the credit bureaus.

Don’t Apply for Unnecessary Credit

It can feel like every day you’re bombarded with credit card applications or offers for great loans. Just because you’re presented with them doesn’t mean you need them.

Only apply for the credit you actually need and that makes sense for your credit score. Do your research on the product and take time to think about how it might affect your credit score. Don’t take on debt you aren’t 100% sure you can pay on time, and don’t use credit cards as an extension of your income.

Final Thoughts

Tradelines are the bread and butter of your credit score. It pays to take good care of them, understand how they work, and know how to use them to your advantage.

Pull your free credit reports often and take care of any issues that arise with your credit score to keep your credit in tip top shape.