Table of Contents

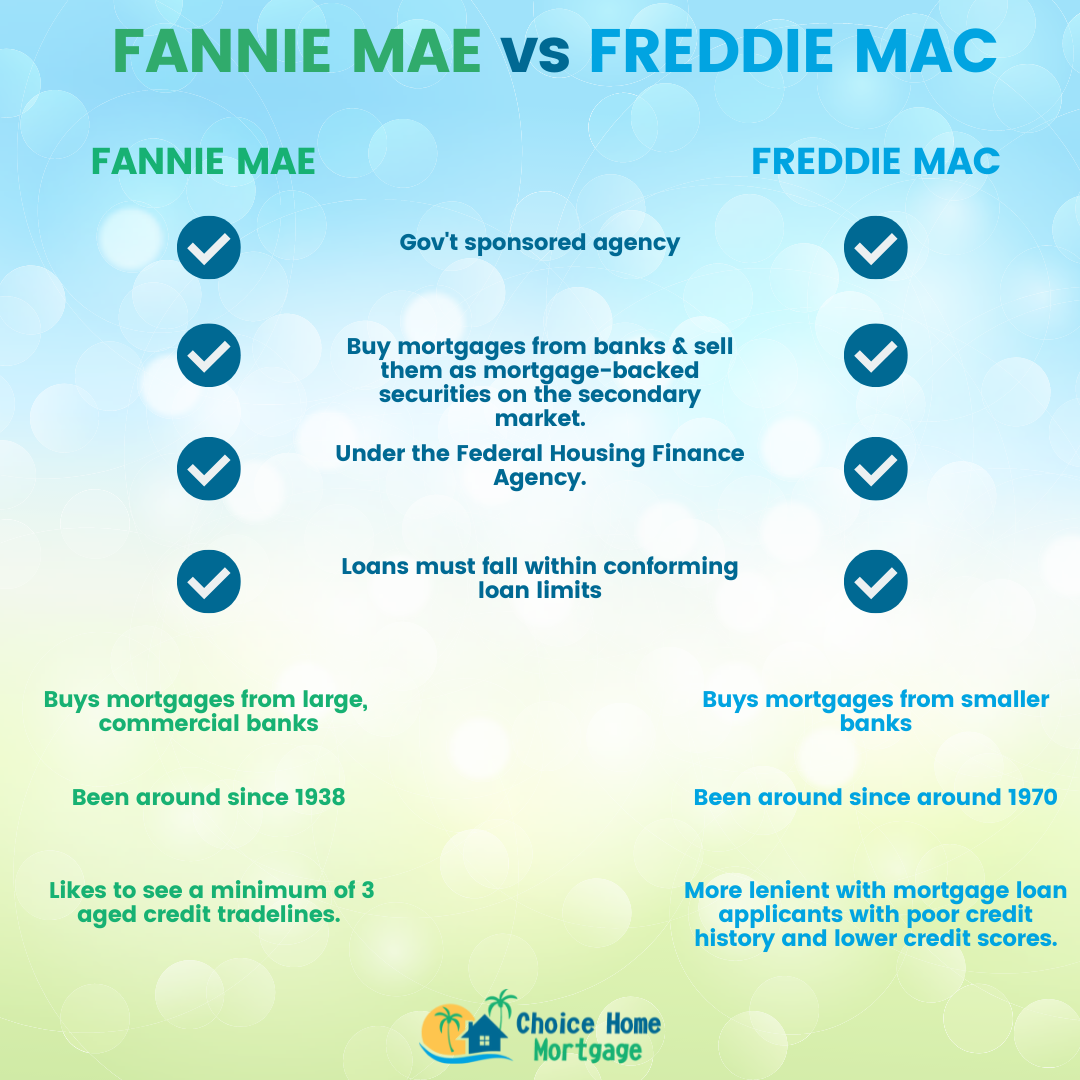

Fannie Mae and Freddie Mac are government-sponsored agencies that help lenders back the loans they fund. They provide liquidity in the mortgage industry and are vital to the well-being of most lenders. Here’s what you must know.

What is Fannie Mae?

Fannie Mae is a mortgage institution backed by the federal government. Their job is to buy mortgages from banks, so banks have more capital to keep lending funds. Without this task, banks would have limited capabilities for funding mortgage loans, which would hurt the mortgage and housing industry.

This government-sponsored enterprise’s name is short for Federal National Mortgage Association (FNMA). From 1939 to 1968, FNMA was the only GSE on the market. This meant it was the only entity buying federally backed mortgages (FHA and VA) from banks.

In 1968, Fannie was made into a private shareholder-owned company rather than a government agency to free up government funds. During this time, FNMA was also approved to buy not only FHA and VA loans but also conventional loans. This opened up even more possibilities for banks and helped grow the housing industry.

Fannie Mae was entirely responsible for creating an option for affordable housing and for creating a long-term fixed-rate mortgage.

What is Freddie Mac?

Freddie Mac was created much later than Fannie – with its origins starting in 1970. The Federal Home Loan Mortgage Corporation came into existence thanks to the Emergency Home Finance Act. Its sole purpose was to expand the secondary mortgage market or the market where investors bought mortgage-backed securities to keep the funds flowing to banks.

Freddie Mac from the start didn’t hold onto the mortgages it bought – they sold them directly to the secondary market. Their focus too was not large banks like Fannie Mae, but rather small, private banks that needed more help.

How are Fannie Mae and Freddie Mac Similar?

Fannie Mae and Freddie Mac have many differences, but there are a couple of similarities to understand.

Sell Loans on the Secondary Market

Both Fannie and Freddie buy loans from banks and then sell them as mortgage-backed securities on the secondary market. This provides lenders and banks with more liquidity so they can keep funding mortgages while keeping FNMA and FHLMC with enough capital flowing to continue helping banks.

Government Run

Prior to the housing crisis of 2008, both FNMA and FHLMC were privately owned and run. But the housing crisis changed all of that. Both companies are now government-run to get the housing and mortgage industry back on track. Today they are a government-sponsored enterprise working under the Federal Housing Finance Agency.

How are Fannie Mae and Freddie Mac Different?

It’s a lot easier to point out the differences between Fannie and Freddie as there are many.

Where they Get Mortgages From

FNMA and FHLMC both work in different financial sectors. Fannie Mae buys mortgages from large, commercial banks – the banks you see on every corner and everyone knows their name no matter what state you live in.

Freddie Mac is the purchaser of mortgages from smaller banks. These are the more private banks that don’t have branches throughout the country. Many only have one or two branches.

Qualifying Requirements

Both Fannie and Freddie have different qualifying requirements. You might qualify for a loan from one agency and not the other. This is especially true if you need a low down payment loan. Freddie Mac has more lenient guidelines for low down payment loans. It’s best to work with a lender that offers both FNMA and FHLMC loans, so you have options.

Fannie Mae has Been Around Longer

Fannie Mae started the GSE movement. In existence since 1938, FNMA was started to combat the financial issues hitting most banks during that time. When the Depression started, banks were facing an excessive number of foreclosures, but banks could only withstand so much.

Eventually, they had all their capital outstanding, which left them with no money left to lend. This is when FNMA stepped in and created the liquidity banks needed to continue writing loans. This helped create more jobs and higher home values, which helped the economy.

Freddie Mac was Created to Create Competition

As with any industry, when one company has the reins on everything, it has a monopoly effect, which can be bad for the economy. Freddie Mac came into existence around 1970 to create the competition needed to give lenders more options. This was done to keep costs down, but it also created a competitor for FNMA, which is still the case today.

Are Fannie Mae and Freddie Mac Owned by the Government?

Fannie Mae and Freddie Mac are under government conservatorship. It doesn’t mean they own them, but they do have the right to buy their stock at any time if they feel it’s required.

The conservatorship of FNMA and FHLMC is currently in court, but for now, the entities run as usual, but the government does benefit from their dividends.

How do Fannie Mae and Freddie Mac Help you Save Money?

Fannie Mae and Freddie Mac don’t fund loans. You don’t interact with them at all when you get a mortgage, actually, but they do a lot behind the scenes that helps keep your loan costs down.

Here’s how it works.

- You apply for a mortgage from a lender that offers FNMA or FHLMC loans

- The lender sells loans to FNMA or FHLMC depending on which qualifications you meet

- The money from FNMA and FHLMC go back into the lender pool of funds for lenders to write more loans

- The demand keeps going, which keeps costs down

Without FNMA and FHLMC keeping the liquidation going, there wouldn’t enough mortgage funds to go around. This will means there would be a higher demand than supply which would drive prices up like crazy. Fortunately, with Fannie Mae and Freddie Mac, this isn’t an issue.

What are the FNMA and FHLMC Guidelines?

Every conventional lender has slightly different guidelines, but they base their loans on what Fannie Mae and Freddie Mac say.

As we said earlier, both agencies have slightly different requirements. If you have a lot of risk factors, you may find that Freddie approves you versus Fannie. But if you have great credit and a low debt ratio, you may get a Fannie loan.

Either way, they both offer low costs, great rates, and attractive terms. In general, here’s what you can expect:

Loan Limits

The loan must fall within the conforming loan limits. The Federal Housing Finance Agency changes the conforming loan limits each year based on the average cost of housing each year. In 2022, the limits increased to $647,200. Any borrower that needs over this amount wouldn’t be eligible for a conforming loan.

Loan Term Limits

Conforming loans cannot exceed a 30-year term. There are other options too. If you can afford a larger payment, you can take a 10, 15, 20, or 25-year term to lower your interest rate and overall interest costs. You’ll also own the home faster with these terms.

Proof you can Afford the Loan

Fannie and Freddie task lenders with the responsibility of ensuring you can afford the loan beyond a reasonable doubt. If you can’t prove your income with the requirements they set (paystubs, W-2s, or tax returns) for example, you can get a conforming loan.

To prevent another housing crisis, all loans must have proof of income that leads lenders to believe the borrower can afford the loan without issue.

What Happens if you Don’t Meet the Guidelines?

Fannie Mae and Freddie Mac don’t approve every loan. They need to keep their risk down to keep the process going. But if you don’t meet the guidelines, there are other loan options to choose from, they are just non-conforming loans. You can find options with attractive loan terms, just like you could with Fannie or Freddie.

Must you Know Fannie Mae and Freddie Mac Guidelines?

Here’s the best part.

You don’t have to know anything about Fannie or Freddie to get a loan. What you should focus on is maximizing your credit score, keeping your debt ratio down, and making your loan application as attractive as possible.

Here’s how to maximize your chances of approval.

Improve your Credit Score

Pull your credit and look for any of the following:

- Late payments

- Over 30% of your credit line outstanding

- Collections

- Too many credit accounts open compared to your installment loans

- Too many inquiries

Bring your late payments current, pay your balances down, take care of your collections, and refrain from applying for any new credit. If you have too many credit cards compared to installment loans, close some credit accounts to balance them.

Pay your Debts Down

If you have a lot of debt, pay it down as quickly as you can. It’s best if you pay your revolving debt off in full, but that’s not always possible. At the very least, pay your credit card debts down to 30% of the total credit line.

For example, if you have a $1,000 credit line, don’t have more than $300 outstanding at one time.

Stabilize your Employment

It’s best if you have a 2-year stable employment, but any stability is good. It shows that you can afford the loan and that your income is predictable. If you changed jobs recently, try to keep it within the same industry or be prepared to prove you have the credentials to succeed in the new industry, such as training or education.

Have Money for a Down Payment

If there’s one thing Fannie Mae and Freddie Mac have in common, it’s the need for a down payment. First-time homebuyers need only 3% down in most cases, but you might need as much as 5% or higher, depending on your qualifying factors.

You must prove you have the funds for a down payment by providing your bank or investment statements. The statements must show ownership of the funds and not have any large deposits that could indicate the funds were borrowed.

Frequently Asked Questions – FAQ

Is Fannie Mae more lenient than Freddie Mac?

Many mortgage applicants wonder which mortgage agency is more lenient, especially if they have bad credit or a high debt-to-income ratio. Freddie Mac is the winner in this debate. Fannie Mae has stricter credit and DTI requirements than Freddie Mac, so if you’re on the fence, choose Freddie Mac.

Is a conventional loan Fannie or Freddie?

Conventional loans or conforming loans, conform to the current conventional loan limits. In 2022, that means they are less than $647,200. But, a conventional loan can be either Fannie or Freddie – your qualifying factors determine which is right for you.

How much of a down payment do you need for a Fannie Mae loan?

Both Fannie Mae and Freddie Mac have 3% down payment options, especially if you’re a first-time homebuyer. If you don’t qualify for the 3% down payment, you’ll need a minimum of 5% down on your home.

Final Thoughts

You’ll never deal directly with Fannie Mae or Freddie Mac yourself, but they are your biggest supporters in getting a mortgage. Without them, lenders wouldn’t be able to fund as many loans as they do.

The regulations set forth by both entities differ slightly and they both work with different banks. Fannie works with larger, commercial banks and Freddie works with smaller, private banks.

No matter which type of loan you end up with, they both have favorable terms and can help you get the funds you need. Contact us today if you’re ready to see your eligibility for either loan type and how we can help you!